Secretary’s introduction

The Treasury is the Australian Government’s lead economic adviser.

Our purpose is to provide advice to the government, and implement policies and programs, to achieve strong and sustainable economic and fiscal outcomes for Australians. We aim to help the government respond to a range of complex challenges and uncertainties, address structural challenges and pursue longer‑term national wellbeing and prosperity outcomes.

Over the past year, domestic economic growth has picked up, employment growth has been solid and unemployment has remained low, while inflation has fallen substantially to return to the target range. While the budget position has improved over the past few years, underlying budget pressures remain and productivity growth has been weak. There has been a marked increase in uncertainty in the global economy. Escalating trade tensions risk hindering global growth by disrupting trade and investment flows and driving up costs for businesses and consumers, and there is volatility and uncertainty flowing from these tensions as well as from major global conflicts. Australia is not immune from these global pressures but is well placed to navigate them.

In the year ahead, our work will focus on providing advice to deliver sustainable budget outcomes, improve the productive capacity of our economy and respond to the complex and unpredictable geostrategic environment. We will have a particular focus on delivering more integrated advice and implementation of the government’s housing policy agenda, reflecting the range of new housing functions that have been embedded into Treasury.

Treasury’s effectiveness and influence depends on the quality of our advice and operations. This, in turn, depends on our people. We will continue to focus on growing a capable workforce and improve our management practices to attract, develop and retain the skills we need now and into the future. This includes continuing to uplift our data and digital capabilities, including those related to the application of artificial intelligence.

We will also maintain our focus on building strong relationships across Commonwealth, state and territory governments, international counterparts, and a wide range of external stakeholders to ensure that our advice is well informed and insightful.

I am pleased to present our Corporate Plan as required under paragraph 35(1)(b) of the Public Governance, Performance and Accountability Act 2013 (PGPA Act). This is our primary planning document and has been prepared in accordance with the requirements of the PGPA Act.

I look forward to leading the department in 2025–26, its 125th year, and reporting on our progress in the annual performance statements included in the Treasury Annual Report.

Jenny Wilkinson PSM

Secretary

August 2025

Treasury Corporate Plan

2025–26 to 2028–29

Our purpose

We provide advice to the government and implement policies and programs to achieve strong and sustainable economic and fiscal outcomes for Australians.

Our operating context

- Navigating short-term complexities and uncertainties

- Addressing medium-term structural challenges

- Promoting strong and sustainable outcomes

Our areas of focus

- A strong and sustainable economic and fiscal environment

- Effective government policies, programs and regulation

- Organisational capability, pro‑integrity culture, sound governance and assurance

Our key activities and intended results

Treasury’s policy advice and analysis is impactful, informed and influential

- Treasury’s policy advice on fiscal, macroeconomic, tax, markets and regulatory issues reflects a whole of economy view and supports improved productivity outcomes for the Australian economy.

- Treasury forecasts inform policy advice to government and are in an acceptable range of variance with actuals.

- Budgets, fiscal and economic updates are timely and comply with the Charter of Budget Honesty.

Treasury’s implementation of policies and regulation supports Australia's economy and national interest

- Treasury’s policy advice on markets and regulator issues assists the Australian economy to be competitive and key markets to be dynamic.

- Treasury’s policy advice on prudential and financial market infrastructure issues contributes to the stability of Australia’s financial system and provides confidence to consumers and investors, supporting economic growth.

- Treasury’s policy advice, research and support contributes to improved housing supply, availability and affordability, and ensures that Housing Australia’s social and affordable housing programs meet government objectives.

- Treasury’s delivery of the legislative program is in line with the government’s priorities and within the required timeframes.

- Treasury’s regulatory functions

- Treasury administers Australia's foreign investment framework consistent with Australia's national and economic interests.

- Treasury administers the Payment Times Reporting Scheme to improve payment practices and foster a prompt payment culture to support economic growth and outcomes for small business suppliers

Treasury’s external engagements enable implementation of the government’s economic and fiscal agenda

- Relationships with Treasury ministers, Treasury portfolio agencies and regulators, and key stakeholders enable implementation of the government’s agenda.

- Partnering with international financial institutions promotes international monetary cooperation, fosters financial system stability and economic growth, and facilitates the government’s objectives in international forums.

- Payments to the states and territories (the states) are administered in accordance with the Intergovernmental Agreement on Federal Financial Relations and other relevant agreements between the Commonwealth and the states.

Enablers

People

Successful delivery of our purpose relies on our capable and professional workforce.

We are committed to investing in our people and supporting their wellbeing.

Information management

Access to high quality data, modelling and analysis as well as timely access to information is important for delivering high quality advice to government.

We also rely on responsive information and communication technology solutions as key enablers of our work.

Risk oversight and management

Risk management is an enabler of good decision‑making and robust advice to government. It supports accountability, transparency, and engagement and helps identify opportunities as they arise.

How

- Ensuring our work aligns with our purpose

- Creating and sustaining productive relationships

- Developing high performing teams

- Rewarding an inclusive and pro‑integrity culture

- Sound governance and assurance

Operating context

Environment

Australia’s economy, and Treasury’s operating environment, continues to be shaped by evolving structural and geopolitical forces that are creating significant uncertainty.

Navigating short‑term complexities and uncertainties

Global economic conditions are expected to remain challenging. Geopolitical instability will present a risk to the outlook for some time and weigh on global investment and trade with implications for labour and financial markets. Inflation has come down globally and has returned to the target band in Australia.

Ongoing global uncertainty poses a risk to the outlook for economic activity, commodity prices and inflation. It also creates the risk of volatility in financial markets, with a significant repricing of financial assets likely to have real economy impacts. Australia is not immune to these international tensions and associated uncertainties but is well placed to navigate the challenges.

Domestically, the timing of a recovery in household consumption, led by rising real incomes, will depend on whether households become more cautionary with spending and build saving buffers. Continued subdued productivity growth could lead to lower growth in output and real wages.

Addressing medium‑term structural challenges

Complex structural changes continue to shape Australia’s economic and fiscal performance: the growing care economy, expanding use of data and digital technology, climate change and the net zero transformation.

Geopolitical tensions have the potential to complicate the climate and digital transformations, affect trade and investment flows, increase volatility and make shocks to the economy more likely. Australia’s economic and fiscal performance will depend on harnessing the opportunities that arise from these transitions, managing the challenges and lifting productivity.

Housing remains one of Australia’s biggest challenges, particularly as the population grows. Unaffordable or insufficient housing reduces productivity, economic participation and social inclusion, and adds to fiscal costs. Increasing the supply of affordable and well‑located dwellings will help support Australia’s economy.

Effective competition policy settings are necessary to support the government’s drive for productivity gains and economic resilience.

Treasury will continue advising the government on reforms to:

- boost productivity

- promote well‑functioning markets

- review competition policy settings

- foster appropriate corporate conduct

- ensure the tax system remains equitable, efficient and adequate to fund the government’s spending commitments.

Promoting strong and sustainable outcomes

Treasury will monitor evolving global and domestic economic developments and advise on achieving strong and sustainable economic and fiscal outcomes. We will provide advice to the government on how to strengthen the budget to prepare for future economic shocks and manage long‑term fiscal pressures. We will also provide advice on the operation of the tax system and how it can be improved.

Treasury delivered the Economic Reform Roundtable in August and will support government consideration of matters raised. The Roundtable brought together a mix of leaders from business, unions, civil society, government and other experts to explore ways to improve productivity, enhance economic resilience and strengthen budget sustainability.

Treasury will prepare the 2026–27 Commonwealth Budget, other economic and budget updates, the annual Population Statement and the next Intergenerational Report. Treasury will also deliver on the government’s tax commitments including the tax cuts announced in the 2025–26 Budget and the $1,000 instant deduction.

We will continue to support the economic transformation required to achieve the government’s climate change goals. This includes delivering whole‑of‑economy modelling to inform the Net Zero Plan and the Sustainable Finance Roadmap.

We will implement the National Interest Framework announced as part of the government’s Future Made in Australia package. We will advise on industrial priorities relating to net zero and economic resilience and security, and we will establish the Investor Front Door’s pilot regulatory facilitation services for a number of nationally significant projects.

Treasury will strengthen its risk‑based approach to assessing foreign investment proposals. We will focus on streamlining the approvals of low‑risk investments, increase scrutiny of high‑risk investments, and bolster compliance monitoring and enforcement activities. This will ensure Australia attracts the significant foreign investment needed to promote and protect the national interest.

Treasury will continue to implement the government’s housing initiatives, including the National Housing Accord, and work with Housing Australia to deliver the government’s social and affordable housing commitments. We will advise on approaches to improve housing affordability and supply. This includes supporting the National Housing Supply and Affordability Council in providing independent advice to government and building an evidence base to improve housing outcomes for the community. Treasury will also work to integrate its new responsibilities for homelessness, construction, cities and planning policy to deliver on the government’s policy priorities.

Treasury will provide policy advice to the government, and design and deliver a range of programs and regulatory functions, to support the growth and resilience of small businesses. This includes supporting implementation of the National Small Business Strategy and continuing to improve payment times to small businesses through the effective administration of the recently reformed Payment Times Reporting Scheme.

Treasury will support the government in further strengthening Australia’s key economic institutions, working with the Council of Financial Regulators and other stakeholders. Priorities include continued implementation of the financial sector Regulatory Initiatives Grid and the sustainable finance strategy, the rapid development and use of artificial intelligence technology and the digital transformation occurring within payments and the financial system more broadly.

Through the First Nations Economic Partnership, Treasury will continue to collaborate with First Nations people and communities to support economic empowerment and self‑determination. Priorities include strengthening mainstream systems to better serve First Nations interests, fostering job creation, supporting thriving businesses, and unlocking the potential of land and Native Title to build enduring economic prosperity for First Nations peoples, communities, and organisations.

Capability

Our people

Treasury’s success relies on its capable and professional workforce. We are committed to investing in our people to ensure we deliver on our areas of focus and achieve our purpose. Diversity, wellbeing and integrity are embedded in a supportive culture that enables people to thrive.

Treasury is an Australian Public Service (APS) employer of choice. In 2025–26, Treasury will continue to implement direct actions under our Strategic Workforce Plan (the Plan), that aim to improve workforce capabilities and management practices to attract, develop and retain the skills we need now and into the future.

As Treasury welcomes new staff and functions through machinery of government changes in 2025, our key efforts under the Plan include:

- supporting employees and leaders to manage through change

- implementation of position management to improve reporting through data and metrics

- state office planning.

Implementation of the Plan is complemented by our continued efforts to foster safe, respectful and accessible workplaces and is underpinned by two core strategies:

- the Inclusion and Diversity Strategy 2023–28, where difference is celebrated and used to activate innovative ideas, policies and practices

- the Healthy Minds: Mental Wellbeing Strategy 2022–25, guiding the maturity of our approach to fostering a safe and healthy workplace.

In 2025–26 Treasury remains committed to prioritising APS employment and, strengthening capability, and will seek to bring some ICT and digital solutions core work in‑house, in line with alignments to the APS Strategic Commissioning Framework.

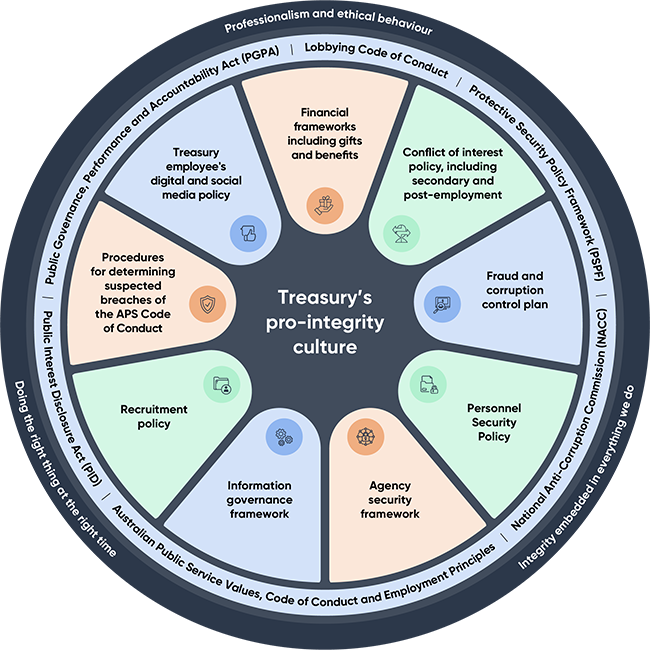

Our pro‑integrity culture

Treasury is committed to the highest standards of integrity, professionalism, and ethical behaviour, including through:

- building and maintaining a pro‑integrity culture

- ensuring integrity is embedded in everything we do as an organisation, and our employees are supported to do the right thing at the right time.

Treasury’s Integrity Strategy 2024–2028 reflects our commitment and approach to building and sustaining trust with government, stakeholders, and the Australian people.

Treasury’s Integrity Framework is a core foundation of the strategy (Figure 1). The Framework brings together standards, legislation, policies and structures to foster integrity and reduce the risk of corruption. In 2025–26, Treasury will continue to embed the Strategy and pro‑integrity culture into everything we do. We will focus on values, behaviours, and institutional practices, and strengthening conflict of interest identification, management, and reporting.

Text description

This circular diagram of Treasury’s Integrity Framework highlights the key legislation, frameworks, policies and processes that provide the foundation blocks for integrity.

The centre of the circle says ‘Treasury’s pro‑integrity culture’.

Inner segments – Policies and processes:

- Financial frameworks including gifts and benefits

- Conflict of interest policy, including secondary and post‑employment

- Fraud and corruption control plan

- Personnel Security Policy

- Agency security framework

- Information governance framework

- Recruitment policy

- Procedures for determining suspected breaches of the APS Code of Conduct

- Treasury employee’s digital and social media policy.

Middle circle – Legislation and regulation:

- Lobbying Code of Conduct

- Protective Security Policy Framework (PSPF)

- National Anti‑Corruption Commission (NACC)

- Australian Public Service Values, Code of Conduct and Employment Principles

- Public Interest Disclosure Act 2013 (PID)

- Public Governance, Performance and Accountability Act 2014 (PGPA).

Outer circle – Principles:

- Professionalism and ethical behaviour

- Integrity embedded in everything that we do

- Doing the right thing at the right time.

The way we work – cooperation and collaboration

Effective stakeholder engagement is core to Treasury’s work. It helps us deliver timely, relevant and influential advice. Stakeholder perspectives improve our advice to government, and the engagement process deepens our relationships with the Australian community.

Treasury’s stakeholder group is broad and diverse. It includes peak bodies, regulators, consumers, academics, business, unions, community groups and other government entities at the international, Commonwealth and state and territory levels. It also includes bilateral and multilateral international cooperation.

Treasury is committed to fostering a culture of effective stakeholder engagement. Building and maintaining cooperative relationships enables Treasury to continue delivering informed and insightful advice.

The Corporate Plan sets out the arrangements for measuring the effectiveness of our stakeholder engagement and consultation. We work closely with the other agencies in the Treasury portfolio, across the Australian Government and with international institutions to deliver our shared objectives and Treasury’s purpose. Treasury uses data from the Australian Prudential Regulation Authority and our work with the International Monetary Fund and the World Bank to demonstrate our performance.

The Australian Centre for Evaluation (ACE) in Treasury provides support across government to enhance the quality and depth of evidence available to help drive better outcomes for individuals, communities and society. The ACE Strategy outlines how Treasury works with entities across government and beyond to oversee a service-wide evaluation capability uplift to improve the volume, quality and use of evaluation evidence, and to help ensure evaluation evidence is at the heart of government decision making. In 2025–26, we will release the Treasury Evaluation Strategy, which will complement and add value to our existing evidence and assurance ecosystem.

Through the First Nations Economic Partnership, Treasury will work in genuine partnership with First Nations partners, peoples and communities by engaging respectfully, collaboratively, and transparently to foster long-term economic empowerment.

Information and communications technology

Treasury continues to focus on improving and strengthening its digital, data, cyber security and artificial intelligence (AI) capabilities. This allows us to enhance our effectiveness, remain relevant and meet stakeholder expectations while working in a safe and secure way.

Improved capabilities allow Treasury to protect against ongoing and emerging cyber threats while creating simple and positive digital experiences for stakeholders. By investing in data and AI capability, and responsibly adopting AI tools, we will leverage contemporary technologies to enhance our policy work and improve our productivity, while preserving trust and confidence.

Treasury will refresh our 2024–26 Digital and Cyber Security Strategy in 2025–26. We will ensure it remains aligned to our current purpose and meets the Treasury’s digital needs. It will continue to support employees in adopting and using digital solutions and further enhancing our existing systems. The refresh will mean we remain forward‑looking, use emerging technologies and consider whole of government initiatives.

During 2025–26, Treasury will develop and launch its second Enterprise Data Strategy. This Strategy will set out a vision and direction for investment in data culture, capability, governance and use across Treasury and will complement the Digital and Cyber Security Strategy. Across 2025–26, Treasury will integrate guidance on, and oversight of, AI into its existing strategies and governance arrangements.

Risk oversight and management

Risk management at Treasury enables good decision making and robust, high‑quality, timely advice to government.

Our risk management policy and framework support Treasury’s accountable authority, the Secretary, to meet her obligations under section 16 of the PGPA Act in line with the Commonwealth Risk Management Policy.

In 2025–26, we will continue to embed risk‑based decision‑making and practices in our day‑to‑day operations and governance arrangements, in line with the risk management policy and risk management framework finalised in late 2024. We will strengthen our risk management by integrating risk with other governance and strategic planning activities. This will help build risk capability and further mature our approach.

A suite of tools guide implementation of the risk policy and framework for consistent risk identification, communication, monitoring and decision making. We identify and manage risk and opportunities at the group and program level, overseen by our governance committees. At the operational level, our focus is on risk identification, assessment, and effective controls, with escalation through appropriate governance channels. In 2025–26, Treasury will build on its first enterprise‑wide climate risk and opportunity assessment undertaken in 2024 under the Commonwealth Climate Risk and Opportunity Management Program. Treasury’s risk management arrangements are reviewed on a cyclical basis to ensure currency and effectiveness.

Risk appetite and tolerance

Treasury strives to achieve the right balance between engaging with risk to effectively deliver our policy and program outcomes, while upholding accountability requirements and protecting the reputation of the department and our status as trusted advisers.

To deliver on our purpose, we have a moderate appetite to engage with risk. Treasury must consider our appetite for pursuing risk in the context of the potential consequences of each risk we take, that is, our risk tolerance. Our tolerance for risk varies depending on the activity. Acceptance of risk within the agreed tolerance range is based on good professional judgement. This requires everyone to understand potential threats and opportunities and focus on ensuring there are sensible measures in place to mitigate and manage undesirable outcomes.

Enterprise risks

Treasury has identified risks that may impact our ability to deliver our purpose and priorities, and the opportunities we must pursue and realise. The presentation of our enterprise risks deliberately focuses on the actions required by staff to effectively manage our enterprise risks.

Influential, impactful and trusted policy advice and analysis

| Enterprise risk 2025–26 | Risk tolerance |

|---|---|

1. Relationship riskWe build and leverage our relationships with government, portfolio entities, and other stakeholders to enable delivery of timely, relevant, and influential advice and analysis. |

Tolerance for relationship risk ranges from low to medium. |

2. Modelling and analytical capability riskOur investment in modelling and analytical capability supports the provision of advice which is reliable and timely in a rapidly changing economic environment, including the transition to a net zero economy; at times this may require an iterative approach to delivering and improving our analysis. |

Tolerance for modelling and analytical capability risk ranges from low to medium. |

3. Policy and regulatory reform riskWe realise opportunities to drive policy and regulatory reform to improve Australia’s economic outcomes, acknowledging the ultimate decisions sit with government. |

Tolerance for policy and regulatory reform risk ranges from low to high. |

Risk management strategy

Effective stakeholder engagement is core to establishing and maintaining trust and is embedded into our processes through dedicated engagement functions.

Robust arrangements are in place to protect the integrity of policy consultation activities.

We measure the accuracy, timeliness, and robustness of our microdata and analysis to assess our performance and inform areas of improvement.

We focus on key threats and opportunities with respect to economic outcomes, including increased international uncertainty and the net zero transition.

The risk appetite and tolerance settings encourage engagement with opportunities to maximise the benefit they represent.

Delivery of the economic agenda

| Enterprise risk 2025–26 | Risk tolerance |

|---|---|

4. Economic policy and program riskWe deliver the government’s economic policy and program priorities in a timely manner and realise the intended benefits; at times this may require pursuing innovative and time critical solutions. |

Tolerance for economic policy and program risk ranges from low to high. |

5. Housing policy and program riskWe deliver the government's housing policy and program priorities, with the aim to improve housing outcomes for all Australians; this may involve utilising novel partnership delivery arrangements, iterated over time to solve longstanding problems. |

Tolerance for housing policy and program risk ranges from low to high. |

6. Legislative program riskWe manage our legislation program efficiently with legally robust laws that reflect government priorities. |

Tolerance for legislative program risk ranges from low to medium. |

7. Payment riskOur payments to the states and territories are timely and accurate, and we meet our international obligations. |

Tolerance for payment risk ranges from very low to low. |

8. Regulation administration riskOur administration of regulation is effective, flexible, transparent, and fair, and we avoid creating unnecessary burdens on, or uncertainty for, industry and consumers. |

Tolerance for regulation administration risk ranges from low to high. |

Risk management strategy

Targeted risk assessments and established business plans minimise possible disruptions and shield us from emerging risks.

We engage broadly across the diverse range of our stakeholders, including affected parties.

We build our internal capability to support the planning, consultation and analysis needed to enable effective partnerships and solutions.

Treasury’s activities are documented and reviewed through governance and assurance mechanisms to ensure they align with the expectations of government and interested parties including the wider public.

We assess outcomes against pre‑established performance indicators that are open to scrutiny through reporting processes including Treasury’s annual report.

People, capability and culture

| Enterprise risk 2025–26 | Risk tolerance |

|---|---|

9. Staff capability riskWe value, develop and use the full potential of our staff, including the attraction, retention and development of talent and future leaders. |

Tolerance for staff capability risk ranges from low to high. |

10. Culture riskWe sustain and embed a diverse and inclusive culture which promotes safety, wellbeing, compliance, accountability, ethics and integrity, business resilience and security awareness in our people to support our workforce, relationships, reputation, and ability to deliver. |

Tolerance for culture risk ranges from very low to low. |

11. IT systems, cyber security, governance and capability riskWe invest in information management systems, cyber security, governance and IT capability and culture to minimise risk of loss or misuse of our information, safeguard against cyber security threats and increase efficiency and effectiveness. |

Tolerance for IT systems, cyber security, governance and capability risk ranges from very low to medium. |

Risk management strategy

Our Strategic Workforce Plan outlines our people initiatives and priorities including embedding appropriate behaviours through leadership expectations and responsibilities; contemporary workplace strategies, policies and procedures; and providing a safe environment where inclusion, diversity, wellbeing, and continual learning is encouraged and supported at all levels.

Our Digital and Cyber Security Strategy outlines our direction in digital and cyber security. It is our roadmap to optimising our information management practices, creating a positive information experience for all, transforming our information management culture, and becoming a future focused organisation with investments in people, process and technology over a multi‑year period. This includes exploring new technologies such as generative AI.

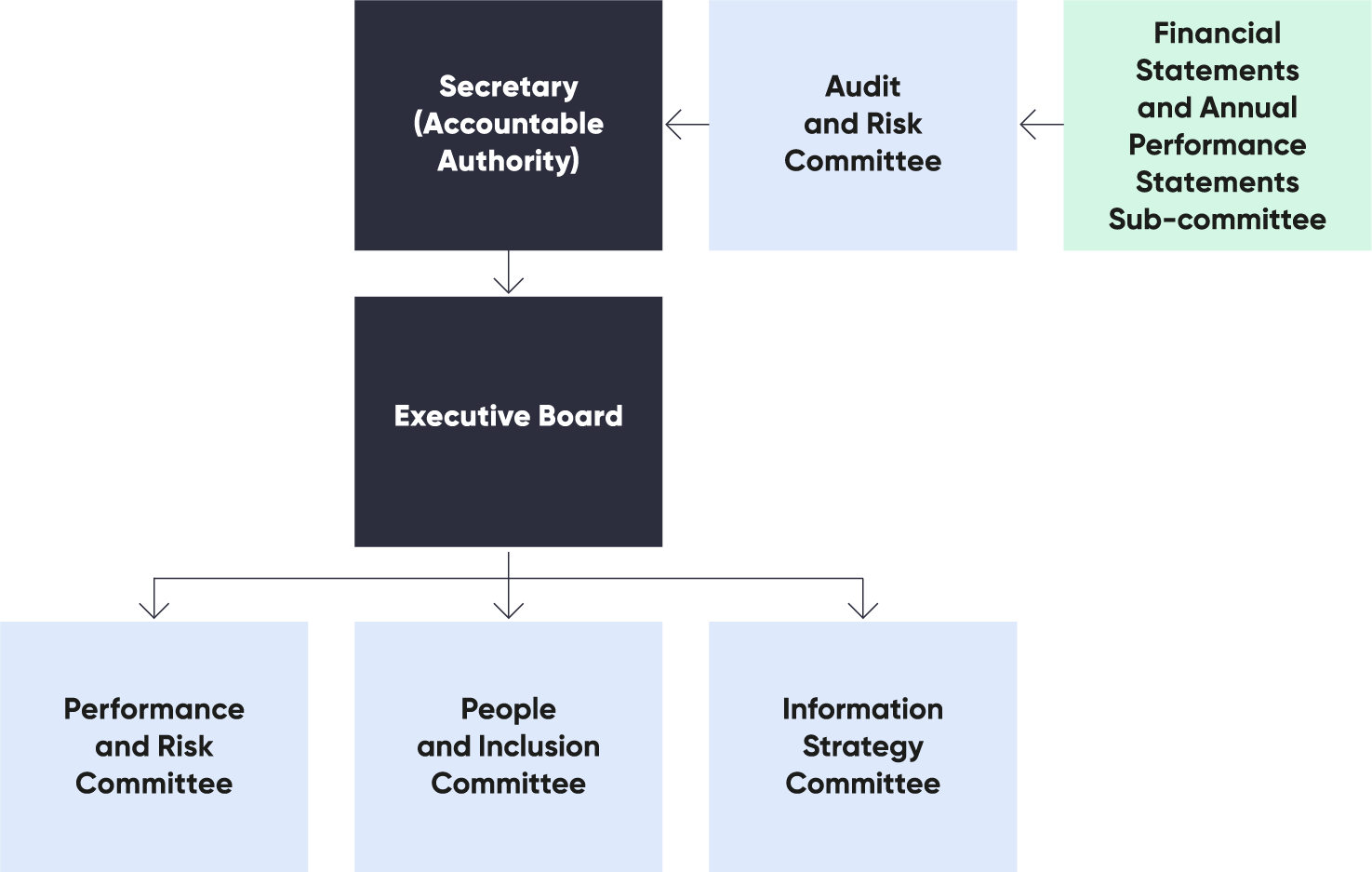

Governance

An impactful and efficient governance structure enables Treasury to achieve our purpose and meet our performance objectives.

Our enterprise governance committees provide transparency, direction and oversight of the risks and complex strategic and operational matters that affect Treasury. In 2025–26, we will continue to embed our governance practice throughout the department and ensure our governance operating model enables management to exercise effective oversight. This includes continuing to incorporate climate risk and opportunity reporting into existing governance structures. This means we can ensure governance arrangements continue to support Treasury’s resilience to climate risk and its capability to realise opportunities in the net zero transition.

Text description

This diagram shows the structure of Treasury’s governance committees.

- Secretary (Accountable Authority)

- Audit and Risk Committee

- Financial Statements and Annual Performance Statements Subcommittee

- Executive Board

- Performance and Risk Committee

- People and Inclusion Committee

- Information Strategy Committee

- Audit and Risk Committee

Our approach to performance

The Corporate Plan 2025–26 is Treasury’s primary planning document.

Treasury continues to improve our performance framework to better reflect what we do and to tell our story. Treasury reviews the performance framework annually for completeness.

Our performance measures reflect a range of qualitative and quantitative measures. We refine our performance assessment methodologies through each reporting cycle. We rely on existing data sources, including publicly available and third party. Further insights come from an independent stakeholder survey and structured interviews with Treasury ministers or their representatives. This approach informs our decision‑making and improves the reliability and verifiability of performance reporting over time.

Treasury has introduced three new performance measures for 2025–26 to replace ceasing measures and expand on the performance reporting of our regulatory functions. The new performance measures have been tested through internal reporting and audit to meet the requirements of the Public Governance, Performance and Accountability Rule 2014.

On 13 May 2025 Treasury received additional functions through the new Administrative Arrangements Order. Treasury will review its performance framework for completeness, including the transferred functions, to determine if a variation to this Corporate Plan 2025–26 is required, or the functions can be incorporated into established performance measures.

Treasury’s Foreign Investment Framework and Payment Times Reporting Scheme are included in the Corporate Plan in accordance with the official guidance issued by the Department of Finance on Regulator Performance. The Ministerial Statement of Expectations and the Regulator Statement of Intent for the Payment Times Reporting Scheme are available on the regulator’s website: paymenttimes.gov.au.

Key activity 1: Treasury’s policy advice and analysis is impactful, informed and influential

Intended result 1.1

Treasury’s policy advice on fiscal, macroeconomic, tax, markets and regulatory issues reflects a whole of economy view and supports improved productivity outcomes for the Australian economy.

| Targets | Ministerial feedback questionnaire | Stakeholder survey |

|---|---|---|

| 2025–26 | 87% | 80% |

| 2026–27 | 87% | 81% |

| 2027–28 | 100% | 82% |

| 2028–29 | 100% | 82% |

Target rationale

Treasury established an 80% target for the ministerial feedback questionnaire and stakeholder survey based on 2021–22 survey results. Treasury increased the target for the ministerial feedback questionnaire for 2025–26 and forward years to align with the methodology for assessing performance and the prior year performance results. Treasury has increased the targets for the stakeholder survey in the forward years based on improvements in the 2024–25 performance results.

Methodology

Independent stakeholder survey with key government entities and stakeholders conducted by a third‑party provider, and structured interviews with Treasury ministers or their delegates. The assessment of the ministerial feedback questionnaire will be weighted so that the Treasurer’s responses account for 50% of the overall percentage measure. Stakeholder selection is governed by transparent stakeholder selection rules.

Measure type

Effectiveness measure.

Data sources

Stakeholder lists and responses to the stakeholder survey and the ministerial feedback questionnaire from Treasury Ministers or their delegates.

Changes from previous year

The target for the ministerial feedback questionnaire has increased from 83% to 87% for 2025–26 and 2026–27 and increases to 100% in the forward years. The target for the stakeholder survey remains at 80% in 2025–26 with incremental increases in the forward years. Treasury will review its stakeholders and areas of policy advice to incorporate functions transferred to Treasury through the machinery of government changes.

Intended result 1.2

Treasury forecasts inform policy advice to government and are in an acceptable range of variance with actuals.

| Targets | |

|---|---|

| 2025–26 | Real GDP falls within 70% confidence interval of forecast real GDP |

| 2026–27 | Real GDP falls within 70% confidence interval of forecast real GDP |

| 2027–28 | Real GDP falls within 70% confidence interval of forecast real GDP |

| 2028–29 | Real GDP falls within 70% confidence interval of forecast real GDP |

Target rationale

Consistency of economic and fiscal forecasts and projections are important for government decision-making. The confidence interval is a widely used metric that provides a guide to the degree of uncertainty around forecasts, assuming that forecast errors are consistent with the distribution of past forecast errors. The choice of a 70% confidence interval is consistent with the narrower of the two confidence intervals published in Budget papers (the other confidence interval being 90%) which is also consistent with the narrower of the two confidence intervals published by the Reserve Bank of Australia for their forecasts.

Methodology

Assessment of the variance between forecasts and outcomes in each year for real GDP growth. Real GDP forecasts incorporate assumptions, that include exchange rates, interest rates, commodity prices and population growth. The confidence interval is a widely used metric that provides a guide to the degree of uncertainty around forecasts. The 70% confidence interval means there is a 70% chance that the outcome falls in this range. This assumes future forecast errors are consistent with the distribution of past forecast errors from 1998–99 onwards.

Measure type

Effectiveness measure.

Data sources

Australian Bureau of Statistics Australian National Accounts: National Income, Expenditure and Product and Budget papers.

Changes from previous year

Treasury developed this performance measure for 2022–23 and there are no changes for the 2025–26 reporting period.

| Targets | |

|---|---|

| 2025–26 | Total Tax Receipts (excluding company tax) for 2025–26 falls within 70% confidence interval of forecast at the 2025–26 Budget |

| 2026–27 | Total Tax Receipts (excluding company tax) for 2026–27 falls within 70% confidence interval of forecast at the 2026–27 Budget |

| 2027–28 | Total Tax Receipts (excluding company tax) for 2027–28 falls within 70% confidence interval of forecast at the 2027–28 Budget |

| 2028–29 | Total Tax Receipts (excluding company tax) for 2028–29 falls within 70% confidence interval of forecast at the 2028–29 Budget |

Target rationale

Consistency of economic and fiscal forecasts and projections are important for government decision making. The confidence interval is a widely used metric that provides a guide to the degree of uncertainty around forecasts, assuming that forecast errors are consistent with the distribution of past forecast errors. The choice of a 70% confidence interval is consistent with the narrower of the two confidence intervals published in Budget papers (the other confidence interval being 90%) which is also consistent with the narrower of the two confidence intervals published by the Reserve Bank of Australia for their forecasts.

Methodology

Assessment of the variance between forecasts and outcomes in each year for actual total tax receipts (excluding company tax). Tax receipts forecasts are generally prepared using a ‘base plus growth’ methodology. The last outcome for each head of revenue is the base to which growth rates are applied, using appropriate economic parameters. Estimates for the current year also incorporate recent trends in tax collections. The confidence interval is a widely used metric that provides a guide to the degree of uncertainty around forecasts and a basis for assessing forecasting performance. The 70% confidence interval means there is a 70% chance that the outcome falls in this range. This assumes future forecast errors are consistent with the distribution of past forecast errors from 1998–99 onwards.

Measure type

Effectiveness measure.

Data sources

Australian Bureau of Statistics Australian National Accounts: National Income, Expenditure and Product, Budget papers and Final Budget Outcome.

Changes from previous year

Treasury developed this performance measure for 2022–23 and there are no changes for the 2025–26 reporting period.

Intended result 1.3

Budgets, fiscal and economic updates are timely and comply with the Charter of Budget Honesty.

| Targets | |

|---|---|

| 2025–26 | 100% |

| 2026–27 | 100% |

| 2027–28 | 100% |

| 2028–29 | 100% |

Target rationale

The Charter includes specific timelines and requirements that must be met. Treasury has delivered in accordance with the Charter over previous reporting periods. The 100% target is an indication of the importance of these deliverables.

Methodology

Assessment against the requirements and timeframes for the public release of the deliverables set out in the Charter for the 2025–26 reporting period. The deliverables for performance reporting in this period are the 2024–25 Final Budget Outcome, 2025–26 Mid‑year Economic and Fiscal Outlook, and 2026–27 Budget. Additional reporting may also be required if the conditions of Part 6 and Part 9 of the Charter are met, if the Treasurer releases an Intergenerational Report or if a statement of Commonwealth stock and securities is required.

Measure type

Output measure in relation to compliance. Timeliness measure as a proxy for efficiency.

Data sources

The released documents for the Final Budget Outcome, Mid‑year Economic and Fiscal Outlook and Budget, and if provided, the Intergenerational Report and additional statement of Commonwealth stock and securities.

Changes from previous year

The 2025–26 performance measure allows for additional assessment against the requirements and timeframes of the Charter for the Intergenerational Report, should it be released during the reporting period. The pre‑election economic and fiscal outlook is not included in the 2025–26 requirements.

Key activity 2: Treasury’s implementation of policies and regulation supports Australia’s economy and national interest

Intended result 2.1

Treasury’s policy advice on markets and regulator issues assists the Australian economy to be competitive and key markets to be dynamic.

| Targets | |

|---|---|

| 2025–26 | Competitiveness score ≥105 |

| 2026–27 | Competitiveness score ≥105 |

| 2027–28 | Competitiveness score ≥105 |

| 2028–29 | Competitiveness score ≥105 |

Target rationale

Treasury developed the competitiveness score of 105 for the 2022–23 and forward year reporting periods based on the 2022 data for 15 criteria of the World Competitiveness Rankings. The 15 criteria relate to areas of Treasury’s policy responsibility. The target reflects the performance goal of maintaining or improving Australia’s competitiveness in areas related to market performance that are within the policy responsibilities of Treasury. The target was substantially achieved in prior year reporting and remains valid.

Methodology

The Institute for Management Development (IMD) produces a World Competitiveness Ranking based on a range of criteria. Fifteen of these criteria relate to the Treasury in the areas of policy responsibility for financial system, investment, retirement incomes, provision of actuarial services, and corporations, competition, and consumer data and law. Other performance measures do not assess these policy areas. IMD calculates the average value for each economy for publication in the IMD World Competitiveness Yearbook each year. Treasury will use the results against the 15 criteria to construct a competitiveness score relevant to this performance measure as an indicator of Treasury’s policy effectiveness.

Measure type

Effectiveness measure.

Changes from previous year

Treasury established this performance measure in the Corporate Plan 2022–23 with the target set during the first year. There are no changes for the 2025–26 reporting period.

Intended result 2.2

Treasury’s policy advice on prudential and financial market infrastructure issues contributes to the stability of Australia's financial system and provides confidence to consumers and investors, supporting economic growth.

| Targets | |

|---|---|

| 2025–26 | No disorderly failures of prudentially regulated institutions |

| 2026–27 | No disorderly failures of prudentially regulated institutions |

| 2027–28 | No disorderly failures of prudentially regulated institutions |

| 2028–29 | No disorderly failures of prudentially regulated institutions |

Target rationale

No disorderly failures of prudentially regulated institutions supports financial system stability and economic growth. Treasury’s policy advice on the regulatory framework targets very low, but not zero, incidences of failure of the regulated entities. The orderly transfer or exit of prudentially regulated entities is part of a competitive financial system.

Methodology

A disorderly failure of a prudentially regulated institution occurs when there is material disruption to the critical economic functions and services that the institution provides, and that this results in significant impacts on the financial system and the wider economy. Treasury will rely on regular bilateral engagement with the Australian Prudential Regulation Authority (APRA) to obtain information on prudentially regulated institutions that have failed or are at significant risk of failure.

Measure type

Effectiveness measure.

Data sources

Australian Prudential Regulation Authority data for the Money Protection Ratio and register of prudentially regulated entities at the beginning and end of the relevant reporting period.

Changes from previous year

Treasury established this performance measure in the Corporate Plan 2022–23 and there are no changes for the 2025–26 reporting period.

Intended result 2.3

Treasury’s policy advice, research and support contributes to improved housing supply, availability and affordability, and ensures that Housing Australia’s social and affordable housing programs meet government objectives.

| Targets | |

|---|---|

| 2025–26 | 8,000 dwellings contracted |

| 2026–27 | 8,000 dwellings contracted |

| 2027–28 | 8,000 dwellings contracted |

| 2028–29 | Contracts are not planned in this forward year |

Target rationale

The performance targets are calibrated to government policy targets for the delivery of social and affordable housing. The Housing Australia Future Fund supports the delivery of 30,000 dwellings over five years to 30 June 2029, with the National Housing Accord Facility to support a further 10,000 dwellings over the same period. Annual targets are calculated by apportioning the 40,000 dwellings over 2025–26 to 2029–30, less the number of dwellings contracted prior to 1 July 2025, and accommodates the development of construction capability to deliver housing.

Methodology

Calculation of the number of dwellings for acquisition, construction, refurbishment or otherwise intended to be available for social or affordable housing that are contracted in the financial year assessed against the target. A contracted dwelling is a contract for the disbursement of grant funds or concessional loans made to an eligible entity by Housing Australia.

Measure type

Effectiveness measure.

Data sources

Data will be provided by Housing Australia to Treasury via a formal report to the Minister for Housing and Homelessness. These data are for dwellings contracted under the Housing Australia Future Fund and National Housing Accord Facility, evidence of contracts signed, and independent audit reports.

Changes from previous year

This performance measure commences in 2025–26.

Intended result 2.4

Treasury’s delivery of the legislative program is in line with the government’s priorities and within the required timeframes.

| Targets | |

|---|---|

| 2025–26 | 94% |

| 2026–27 | 94% |

| 2027–28 | 94% |

| 2028–29 | 94% |

Target rationale

Legislative measures are routinely added to, rescheduled, or removed from the legislation program following changes to government priorities or adjustments to the delivery timing. The dynamic nature of the environment in which Treasury delivers the legislation program includes factors outside of Treasury’s control. The target has been increased based on the performance results in prior years.

Methodology

Calculation of the legislative measures committed for delivery, adjusted for reprioritisation, and compared with the legislative measures actually delivered. Treasury manages and delivers legislative measures during Parliamentary sitting periods. Accordingly, Treasury assesses performance based on the sequence of Winter and Spring Parliamentary sitting periods in one calendar year and Autumn Parliamentary sitting period in the following calendar year. This provides the best alignment with the performance reporting period. To provide a more accurate synopsis of Treasury’s delivery of the government’s legislative agenda we have excluded routine, annual or minor and technical legislative measures from the performance measure. Treasury assesses performance against the delivery of legislative measures that implement priority policies as announced by government.

Measure type

Output measure.

Data sources

Treasury’s Legislative Program provides a record of the government’s current legislative priorities in the Treasury portfolio, which Treasury track through a records management database. The Bills and Legislation page on the Parliament of Australia website is a second data source confirming date of introduction and passage of primary legislation. The Federal Register of Legislation also provides a second data source confirming the date of instrument registration.

Changes from previous year

Treasury has retained this performance measure from the Corporate Plan 2024–25. The target for the 2025–26 reporting period, and the forward years, has been increased in response to prior year reporting.

Intended result 2.5

Treasury’s regulatory functions:

- Treasury administers Australia's foreign investment framework consistent with Australia's national and economic interests

- Treasury administers the Payment Times Reporting Scheme to improve payment practices and foster a prompt payment culture to support economic growth and outcomes for small business suppliers.

| Targets | |

|---|---|

| 2025–26 | 65% |

| 2026–27 | 65% |

| 2027–28 | 65% |

| 2028–29 | 65% |

Target rationale

Survey results from prior years have informed the 2025–26 target. Given that consecutive targets were not achieved, the target of 65% has been retained for 2025–26 and the forward years. Engagement with stakeholders, particularly regulated entities, is maturing.

Methodology

Independent surveys conducted by a third-party provider with foreign investment framework and Payment Times Reporting Scheme stakeholders. Stakeholder selection and questions that align with the Regulator Performance Principles will be governed by transparent stakeholder selection rules. Treasury will report separately on its regulatory functions for the foreign investment framework and Payment Times Reporting Scheme.

Measure type

Effectiveness measure.

Data sources

Responses to the annual stakeholder survey and stakeholder lists.

Changes from previous year

Treasury established a target of 65% for 2022–23 and has maintained this target for 2025–26 and the forward years.

| Targets | |

|---|---|

| 2025–26 | 85% |

| 2026–27 | 85% |

| 2027–28 | 90% |

| 2028–29 | 95% |

Target rationale

The Australian Government’s response to the Statutory Review of the Payment Times Reporting Act 2020 (the Act) committed to overhaul the Payment Times Reporting Scheme. Consequently, Treasury reestablished the Payment Times Reporting Regulator’s performance target for the 2025–26 reporting period. As the most recent performance target was 85% in 2023–24, Treasury considers a baseline target of 85% of regulated entities complying with their reporting obligations to be reasonable.

Methodology

This performance measure assesses the proportion of regulated entities that comply with their obligation to report under the Act, expressed as a percentage of all entities required to be registered to report under the Payment Times Reporting Scheme during the reporting period.

Measure type

Effectiveness measure.

Data sources

Data from the Payment Times Reports Register, the Payment Times Reporting Regulator’s IT system, the Australian Taxation Office and commercial data sources.

Changes from previous year

This performance measure commences in 2025–26.

Treasury removed this performance measure from the Corporate Plan 2024–25 as the Payment Times Reporting Scheme transitioned to new reporting requirements and would not report in the 2024–25 period. Treasury established a replacement measure using a new methodology and data sources for performance reporting in 2025–26 to reflect the regulatory and legislative reforms.

| Targets | |

|---|---|

| 2025–26 | 50% |

| 2026–27 | 50% |

| 2027–28 | 50% |

| 2028–29 | 50% |

Target rationale

The government announced on 1 May 2024 that Treasury will adopt a new performance target of processing 50% of investment proposals within the 30‑day statutory decision period from 1 January 2025.

This target supports the reform agenda to streamline and strengthen Australia’s foreign investment framework. This will be achieved by streamlining the consultation and assessment process for lower risk proposals to enable decisions on foreign investment proposals that are low risk to be made more quickly. Treasury is dedicating more resources for assessing higher risk proposals in critical and sensitive sectors. Higher risk proposals will, and should, take additional time beyond the 30‑day target to be accurately assessed and processed to ensure that risks to the national interest are addressed. The 50% target will primarily be achieved by faster processing of lower risk proposals.

Methodology

The number of commercial foreign investment proposals processed within the 30‑day target period assessed as a percentage of the total number of processed foreign investment proposals in the reporting period. The processing times of each included proposal will be used to calculate the percentage of proposals processed within 30 days. The 30‑day period refers to the initial length of the statutory decision period that commences after notice is given for those types of investment proposals which have a decision period. Proposals which are variations, retrospective, or notifiable action‑only do not meet performance assessment criteria and are not included in this assessment.

Measure type

Efficiency measure – timeliness as a proxy for efficiency.

Data sources

Data reposited in the case processing system used to process commercial foreign investment proposals.

Changes from previous year

This performance measure commences in 2025–26.

Key activity 3: Treasury’s external engagements enable implementation of the government’s economic and fiscal agenda

Intended result 3.1

Relationships with Treasury ministers, Treasury portfolio agencies and regulators, and key stakeholders enable implementation of the government’s agenda.

| Targets | Ministerial feedback questionnaire | Stakeholder survey |

|---|---|---|

| 2025–26 | 87% | 80% |

| 2026–27 | 87% | 81% |

| 2027–28 | 100% | 82% |

| 2028–29 | 100% | 82% |

Target rationale

Treasury established 70% as a baseline for the stakeholder survey and ministerial feedback questionnaire in 2021–22. Treasury has increased the target for the ministerial feedback questionnaire for 2025–26 and forward years to align with the methodology for assessing performance and the prior year performance results. Treasury increased the targets for the stakeholder survey in the forward years based on improvements in the 2024–25 performance results.

Methodology

Independent stakeholder survey conducted by a third-party provider and structured interviews with Treasury Ministers or their delegates. The assessment of the ministerial feedback questionnaire will be weighted so that the Treasurer’s responses account for 50% of the overall percentage measure. Stakeholder selection is governed by transparent stakeholder selection rules.

Measure type

Effectiveness measure.

Data sources

Stakeholder lists and responses to the stakeholder survey and the ministerial feedback questionnaire from Treasury Ministers or their delegates.

Changes from previous year

The target for the ministerial feedback questionnaire has increased from 83% to 87% for 2025–26 and 2026–27 and increases to 100% in the forward years. The target for the stakeholder survey remains at 80% in 2025–26 with incremental increases in the forward years. Treasury will review its stakeholders and areas of policy advice to incorporate functions transferred to Treasury through the machinery of government changes.

Intended result 3.2

Partnering with international financial institutions promotes international monetary cooperation, fosters financial system stability and economic growth, and facilitates the government’s objectives in international forums.

| Targets | |

|---|---|

| 2025–26 | 100% |

| 2026–27 | 100% |

| 2027–28 | 100% |

| 2028–29 | 100% |

Target rationale

Treasury has reported over previous periods that transfers to international financial institutions are within legislated requirements. The target is consistent with these performance results.

Methodology

Assessment of payments against the requirements of relevant legislation and agreements. The performance results will be calculated as a percentage of total payments that meet requirements and timeframes against total payments (all payments including those that do not meet requirements and timeframes) for the period.

Measure type

Output measure.

Data sources

International Monetary Agreements Act 1947 and International Finance Corporation Act 1955, Asian Development Bank Act 1966, Asian Infrastructure Investment Bank Act 2015, European Bank for Reconstruction and Development Act 1990, and payment records from the Reserve Bank of Australia, World Bank, International Finance Corporation, Asian Development Bank, International Monetary Fund, or other multilateral development banks (where relevant).

Changes from previous year

Treasury included this performance measure in the Corporate Plan 2024–25 and there are no changes for the 2025–26 reporting period.

Intended result 3.3

Payments to the states and territories (the states) are administered in accordance with the Intergovernmental Agreement on Federal Financial Relations and other relevant agreements between the Commonwealth and the states.

| Targets | |

|---|---|

| 2025–26 | 100% |

| 2026–27 | 100% |

| 2027–28 | 100% |

| 2028–29 | 100% |

Target rationale

Treasury has reported against this performance measure over previous periods. The target is set in accordance with Treasury’s obligations.

Methodology

Assessment of payments against the requirements of the Intergovernmental Agreement on Federal Financial Relations and other relevant agreements between the Commonwealth and the states. The assessment will be calculated as a percentage of the number of payments that meet requirements against the total number of payments (all payments including those that do not meet requirements) for the period.

Measure type

Output measure.

Data sources

The Intergovernmental Agreement on Federal Financial Relations and other relevant agreements, records of payment requests in the Federal Payments Management System, approvals, and payment advice.

Changes from previous year

Treasury included this performance measure in the Corporate Plan 2024–25 and there are no changes for the 2025–26 reporting period.